Nvidia Corp shares were quiet in the extended session on Wednesday after the chip maker’s holiday quarter beat Wall Street and its own expectations, posting record sales and doubling its profit from a year ago.

Nvidia NVDA,

Shares were down 1% after hours, after advancing less than 0.1% in the regular session to close at $265.11. Stocks closed at cleavage It reached an all-time high of $333.76 on November 29. All stock and stock numbers are shown as split-adjusted.

Nvidia reported fourth-quarter net income of $3 billion, or $1.18 per share, compared to $1.46 billion, or 58 cents per share, in the same period last year. Adjusted earnings, which excludes stock-based compensation expense and other items, was $1.32 per share, compared to 78 cents per share in the same period last year.

Revenue jumped to a record $7.64 billion, up 53% from $5 billion in the same quarter last year. Analysts polled by FactSet estimated adjusted earnings at $1.23 per share on revenue of $7.42 billion. Nvidia executives expected revenue of between $7.25 billion and $7.55 billion in November.

Back in mid-November, Nvidia reported quarterly records across the board – $3.22 billion in game sales, $2.94 billion in data center sales, and $7.1 billion in total sales – Lots of Wall Street Celebration. Nvidia also expected data center sales to grow sequentially faster than game sales in the fourth quarter. a year and a half agoFor the first time, sales of data center chips exceeded those of games, but quickly bounced back.

Read: Nvidia seeks to lead the gold rush into the metaverse with new AI tools

“We are entering the new year with strong momentum across our business and excellent traction with our new software business models with Nvidia AI, Nvidia Omniverse and Nvidia Drive,” Nvidia CEO Jensen Huang said in a statement. “GTC is coming. We will be announcing many new products, applications, and partners for Nvidia computing.”

In the fourth quarter, game sales rose 37% to a record $3.42 billion compared to the same quarter last year, or a sequential increase of 6%. Meanwhile, analysts polled by FactSet forecast Nvidia’s game sales to reach $3.36 billion.

“The quarterly and fiscal year increases reflect higher sales of GeForce GPUs,” Colette Criss, Nvidia’s chief financial officer, said in a statement. “We continue to benefit from strong demand for our Nvidia Ampere architecture products. The quarterly sequential increase in GeForce GPUs was partially offset by a seasonal decline in game console consoles.”

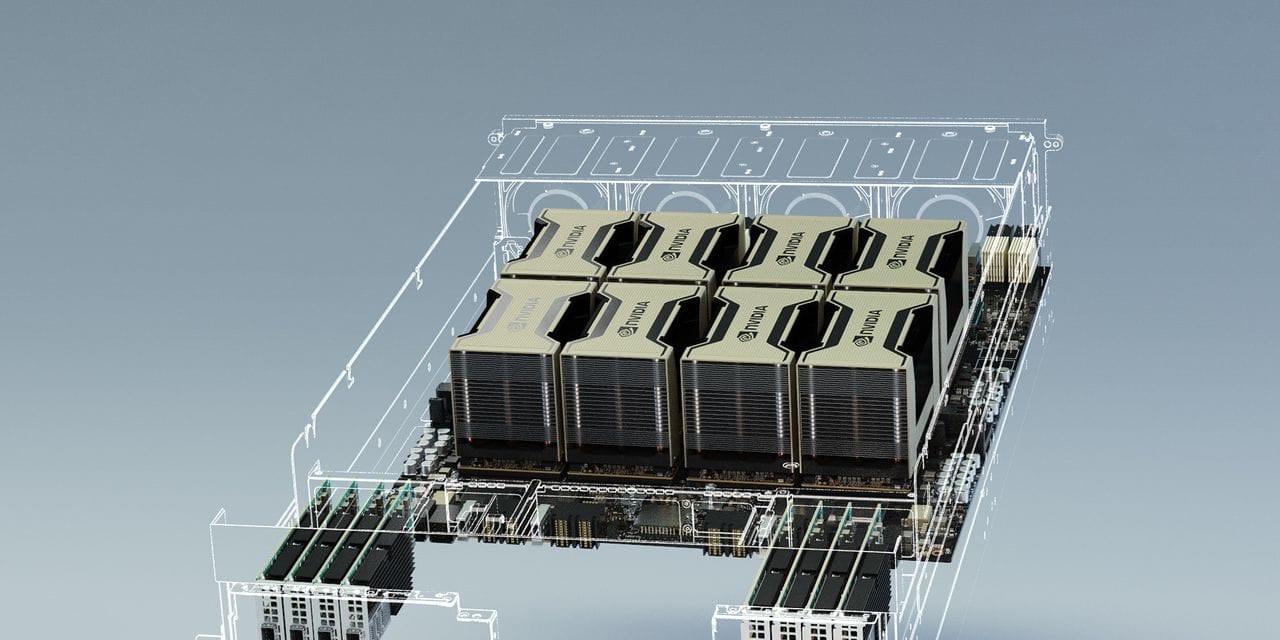

On the data center front, sales rose 71% to a record $3.26 billion from the prior-year quarter, or for a sequential quarterly gain of 11%, while analysts expected sales of $3.18 billion.

“These increases were primarily driven by sales of Nvidia Ampere architecture GPUs across both training and inference for cloud computing and AI workloads such as natural language processing and deep recommendation models,” Chris said in a statement.

For more information: see earnings results from Intel Corporation Beside AMD

For the first or current quarter, the Santa Clara, California-based chipmaker expects revenue of $7.94 billion to $8.26 billion, while analysts forecast revenue of $7.31 billion on average.

The earnings report comes a week after Nvidia’s $40 billion bid to acquire chip designer Arm Ltd. Officially disbandeda lot for Wall Street’s lack of surprise.

Recently, Nvidia overtook Meta Platforms Inc. affiliated with Facebook FB,

to get an address It is the seventh largest publicly traded US company by market capitalization.

Over the past 12 months, Nvidia shares are up 73% by Wednesday’s close, while the PHLX Semiconductor Index SOX,

It rose 10% over that period. Meanwhile, the S&P 500 SPX,

14% gain, the Nasdaq Composite Index,

It was above 1%.